After the shutdown of SMS-Activate in late 2024, the global SMS activation market entered a phase of rapid redistribution. According to industry estimates cited by fintech and cybersecurity media, the demand for SMS activation and receiving SMS online continued to grow in 2025–2026, driven by account verification requirements across Google, Meta, Amazon, and regional platforms. As a result, smaller and mid-sized providers such as OnlineSIM and SMS-MAN saw increased traffic as users searched for alternatives offering virtual numbers and, in some cases, real SIM cards.

This article examines how these two services operate in 2026, what they actually offer in terms of geography, pricing, and number types, and where their approaches differ in practice.

OnlineSIM: controlled access and long-term number usage

OnlineSIM is a relatively new entrant that positions itself closer to a regulated SMS reception service than a typical anonymous SMS activation platform. As of 2026, the service supports 36 countries, with a focus on Russia and nearby regions.

All numbers provided by OnlineSIM are virtual numbers, accessed exclusively through a web interface. A defining feature is long-term number rental — users can keep the same number active for up to six months, receiving SMS messages on a daily basis without a stated limit.

Unlike many competitors, OnlineSIM requires identity verification with a passport photo, which significantly changes its risk profile and target audience.

Verified characteristics of OnlineSIM

- Virtual numbers only (no physical or real SIM cards)

- Country coverage: 36 countries

- SMS received via web dashboard

- Long-term rentals up to 6 months

- Unlimited incoming SMS during rental period

- Pricing starts at approximately $0.11 per number

Observed limitations

User feedback and platform documentation indicate several constraints:

- Mandatory identity verification

- Smaller number pool compared to global platforms

- Occasional delays during SMS activation

📌 From a compliance perspective, OnlineSIM operates closer to long-term receiving SMS use cases rather than high-frequency or disposable activations.

SMS-MAN: scale-driven SMS activation and real SIM cards

SMS-MAN represents a more traditional SMS activation marketplace model. The platform supports over 170 countries and offers both virtual numbers and real SIM cards, depending on region and availability.

The service is designed for flexibility: users can purchase one-time SMS activations, rent numbers, or integrate directly via API. Pricing varies widely, but entry-level activations start at around $0.03, making SMS-MAN one of the lower-cost providers in the segment.

In addition, SMS-MAN publishes a rotating pool of free public numbers for receiving SMS, though these are generally unsuitable for sensitive or high-value accounts due to shared access.

Documented features of SMS-MAN

- Virtual numbers and real SIM cards

- Coverage across 170+ countries

- One-time SMS activation and rentals

- Prices from approximately $0.03 per activation

- Rentals from around $1.00, depending on country

- API designed for automation and bulk operations

- 24/7 customer support availability

Market overlap: what both services actually provide

Despite differences in scale and verification policies, OnlineSIM and SMS-MAN address the same underlying demand:

- Receiving SMS for account verification

- No need for a physical SIM card in most cases

- Web-based access to SMS messages

- Variable availability depending on country and operator

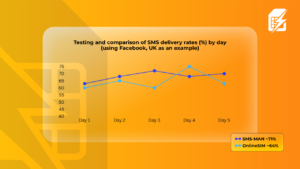

Industry-wide data and platform disclosures confirm that SMS delivery is never guaranteed. Major companies actively filter virtual numbers and even some real SIM cards as part of their anti-fraud systems.

SMS-MAN vs OnlineSIM: Structural differences that matter in practice

| Factor | OnlineSIM | SMS-MAN |

|---|---|---|

| Countries supported | 36 | 170+ |

| Number types | Virtual only | Virtual + real SIM cards |

| Entry price | ~$0.11 | ~$0.03 |

| Long-term usage | Up to 6 months | Flexible |

| Identity verification | Required | Not required |

| API access | Not emphasized | Core feature |

| Typical use case | Persistent SMS reception | High-volume SMS activation |

How users choose between OnlineSIM and SMS-MAN

Market behavior shows two distinct usage patterns:

- OnlineSIM is typically chosen for scenarios requiring stable, repeat receiving SMS on the same number

- SMS-MAN is favored for short-lived SMS activation, automation, and geographic diversity

Neither model eliminates the risk of number blocking, especially on services operated by Google, Meta, or Microsoft.

Reliability and risk factors

Public reviews and industry commentary highlight common issues:

- OnlineSIM: verification friction, limited GEO expansion

- SMS-MAN: blocked numbers on popular platforms, variable quality across regions

These risks are structural to the SMS activation market and are not unique to either provider.

Conclusion

The exit of SMS-Activate reshaped the SMS activation ecosystem, but it did not simplify it. Instead, it pushed users toward platforms with very different philosophies.

- OnlineSIM prioritizes controlled access and long-term number stability

- SMS-MAN emphasizes scale, automation, and access to real SIM cards

In 2026, the choice between them depends less on price and more on whether the goal is persistent receiving SMS or high-volume SMS activation.

FAQ

Are both services suitable for SMS activation?

Yes, but SMS-MAN is structurally better suited for short-term activations.

Do they offer real SIM cards?

Only SMS-MAN provides access to real SIM cards in selected regions.

Is SMS delivery guaranteed?

No. Filtering and delays are common across the entire market.

Which platform supports automation?

SMS-MAN offers API access; OnlineSIM focuses on manual usage.